Best Legal Accounting Software for Small & Large Law Firms

Content

Through the balance sheet, law firm owners will have a solid understanding of the firm’s financial health, and can compare current assets and liabilities. When compared, the company’s liquidity can be ascertained, and the rate at which the company generates returns can be calculated. Cash accounting recognizes revenues when cash is received and expenses when paid. This method of accounting does not recognize accounts receivable or accounts payable. Once you develop a bookkeeping system, business owners will want to consider working with a CPA or professional tax accountant around tax time to handle tax returns. While there are some outsourced services that offer this functionality, so far I’ve found that working with individuals and small accounting firms is better for this task.

If your data isn’t kept up to date, then your legal accountant won’t be able to do their job as effectively. It’s easier to start your legal accounting strong than to fix sloppy accounting done in the past. And with proper legal accounting and bookkeeping, it couldn’t be easier to get a big-picture overview at a glance. Your COA will look different depending on your jurisdiction, law firm’s size, and practice area, but will always have these categories. You’re responsible for recording the receipt and disbursement of these funds and posting the transactions to the ledger accounts of clients. Before the IOLTA, lawyers would store this money in a non-interest-bearing checking account, as they are not allowed to benefit financially from storing a client’s money. When a lawyer holds onto a client’s money, they store it in a trust account.

Connect With Industry Leading Apps To Level Up Your Accounting

Send reports instantly to the bank, partners, or equity members. Another benefit of comparing balance sheets is that you can determine how much a business has grown over different points in time.

Without the essentials, your firm might struggle to stay compliant with ethical rules, and you may inadvertently leave money on the table. During that time, you likely did not learn anything about legal accounting orbookkeeping. So the thought of legal bookkeeping and law firm accounting can sound intimidating to even the most experienced attorneys.

Linda Rost’s Better Bookkeepers

Since revenue isn’t recognized until the cash is paid, there are no income taxes until the money is in your bank account. You can impress clients with professional https://www.bookstime.com/ estimates and invoices that show off your brand. FreshBooks accounting software offers online billing and payment options to get you paid faster.

Friday Footnotes: KPMG Is Twice as Bad as Other Firms; Upskill or Die; Hella M&A 10.21.22 – Going Concern

Friday Footnotes: KPMG Is Twice as Bad as Other Firms; Upskill or Die; Hella M&A 10.21.22.

Posted: Fri, 21 Oct 2022 21:02:37 GMT [source]

As a lawyer, when you receive cash that belongs to a client, you are obligated to hold those funds in a client trust account separate from your own money. Cash accounting is also beneficial because you can look at your bank balance at any time to understand the amount of money available.

You’re our first priority.Every time.

There are a ton of legal accounting software offerings available, but not all of them are created equal. When it comes to the best accounting software for small law firms, LeanLaw is one of our top picks. You can also seek help with different aspects of your law firm, from trust accounting, workflow management, and more through LeanLaw’s partners.

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Whenever you manually enter data into the books, you leave room for errors like a duplicated entry or a wrong number. When an invoice is paid, you should first deduct a portion to pay for those incurred costs. That is, you spend money to handle a client case, doing things like hiring experts. Uptime Practice can help you streamline your merchant processing, automated invoicing, and even your payroll, all from the cloud.

Retainer agreements can get complex, but I don’t need to tell you that. The differentiating factor for accounting is whether there are contingencies or refundability clauses in the retainer contract. It’s customary to use IOLTAs when you’re depositing nominal amounts that would earn little to no interest. The state pools the funds from individual IOLTAs to generate enough revenue to fund the public programs. You’ll want a traditional interest-bearing CTA for substantial deposits or funds you plan to hold long term.

Quickbooks is also the leading software for integrating with practice management software, so I can see why many lawyers would choose it. The Quickbooks pricing model is still a “software as a service” though, so you can expect to pay a monthly fee. Law firms need to spend extra time setting up their accounting software before opening for business. To ensure you set up to track CTAs and retainer payments correctly, engage a law accountant. There are certain conditions this kind of software has to meet.

FreshBooks accounting software is built around ensuring you get paid every penny for your hard work. It’s law firm bookkeeping simple to create and customizing an invoice, add your logo and personalize your “thank you” email.

- When it comes to organization, getting off on the right foot should help you stay more organized now and into the future.

- You can classify trips as business or personal later on and add client information.

- LeanLaw helps you understand profitability, not just cash flow.

- Having cash in your savings account can improve your chances of being approved for loans and other lines of credit in the future.

- The retainer fee goes into a CTA, and you can draw from it as the client approves invoices for services rendered.

Owners, called partners, enjoy the benefits of pass-through taxation under a shield that protects their personal assets from business liabilities. Refundable retainers — where the client may have a refund for hours prepaid but not worked during the month — are what accountants call unearned or deferred revenue. The retainer fee goes into a CTA, and you can draw from it as the client approves invoices for services rendered. Law firms juggle their clients’ money more than in most industries. Accountants in law spend much of their time tracking what money the firm earned and what needs to go to clients, the courts, or third parties. Larger law firms that need an all-in-one accounting system with more advanced features should consider tools like PCLaw and LeanLaw. Zola Suite might be the best choice for you if you need a platform that includes CRM capabilities.

Join thousands of clients nationwide.

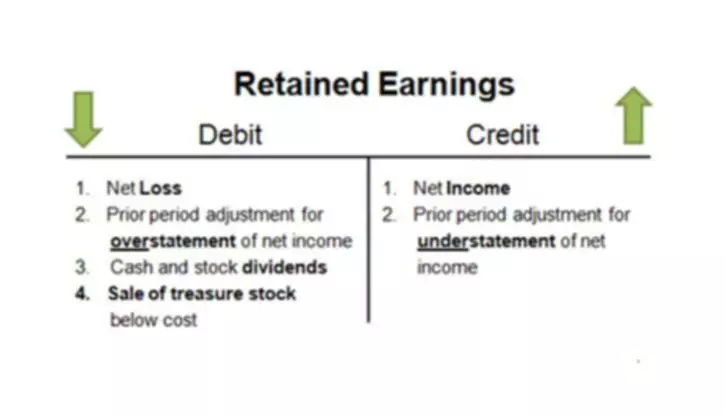

Controllers often oversee the bookkeeper’s work, reconcile the accounts, and make more significant ledger adjustments. They can use your financial data to understand what it tells you about your business. First things first, bookkeeping and accounting aren’t the same things. Although they share a common goal, they occur at different stages of managing your firm’s finances. Bookkeeping happens first and relates to the administrative side of tracking your cash. Interestingly, tax deductions can ease the burden when used correctly—yet not all lawyers are up-to-date on their tax deductions.